Complete Factoring management solutions

We support specialized financial companies and banking institutions which operate in the domestic and international Factoring market with innovative, secure and intuitive digital solutions.

DISCOVER OUR SOLUTIONS

Finwave is a leader in IT solutions for Italian banking and financial services operators specialized in Factoring.

Thanks to extensive knowledge of the business gained over more than thirty years of activity in the sector, and thanks to partnerships with numerous players – from leaders in the Italian market to startups – Finwave’s Factoring K4F platform represents a complete, scalable solution, featuring extensive integration capabilities and based on state-of-the art technologies.

Why choose Finwave?

- It is an Assifact and FCI (Factor Chain International) partner

- It has integrated its solutions with the major Italian outsourcers for core banking systems

- It has developed partnerships with the main Infoproviders and with the most innovative providers of risk management tools and solutions

- Thanks to its business experience, it is able to support clients throughout all project phases, whether replacing IT systems or starting up Factoring operations.

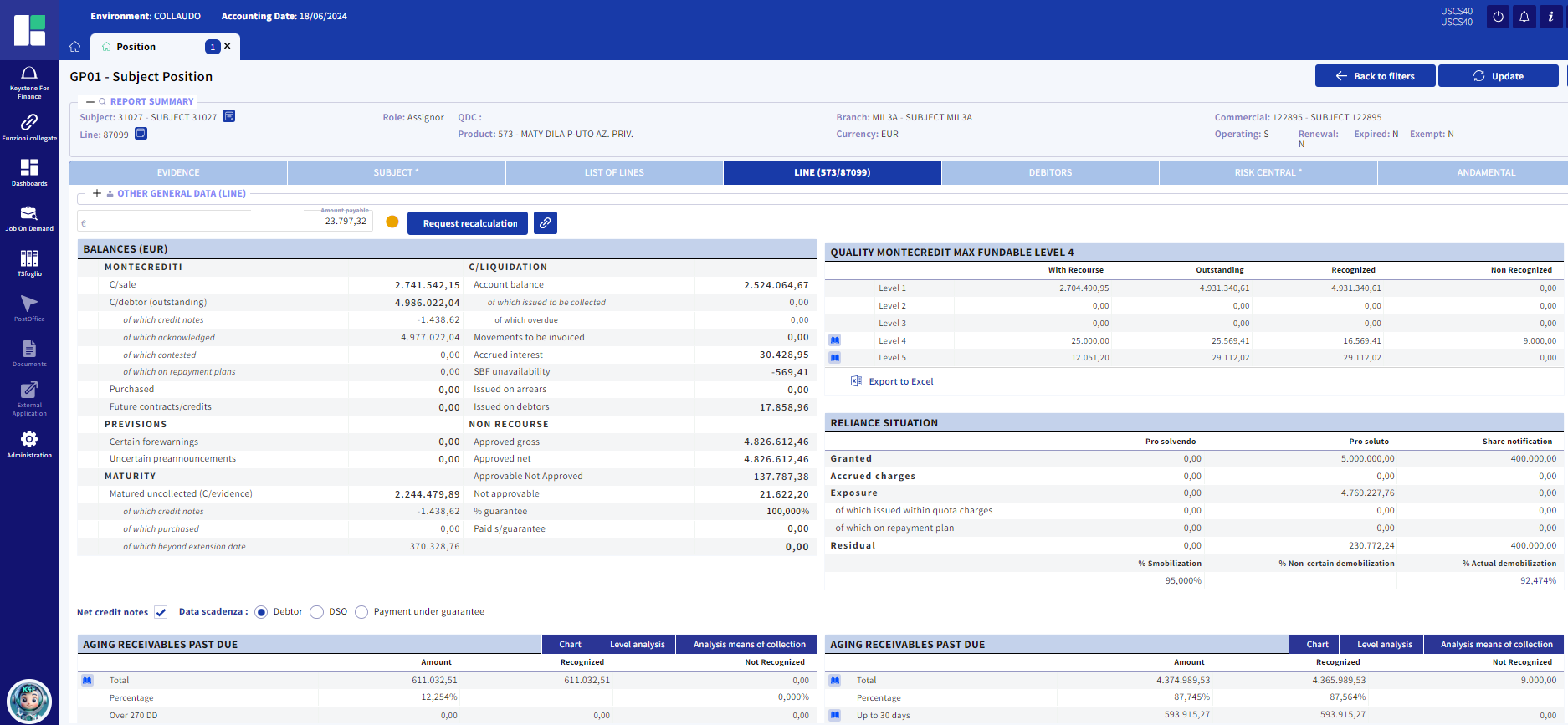

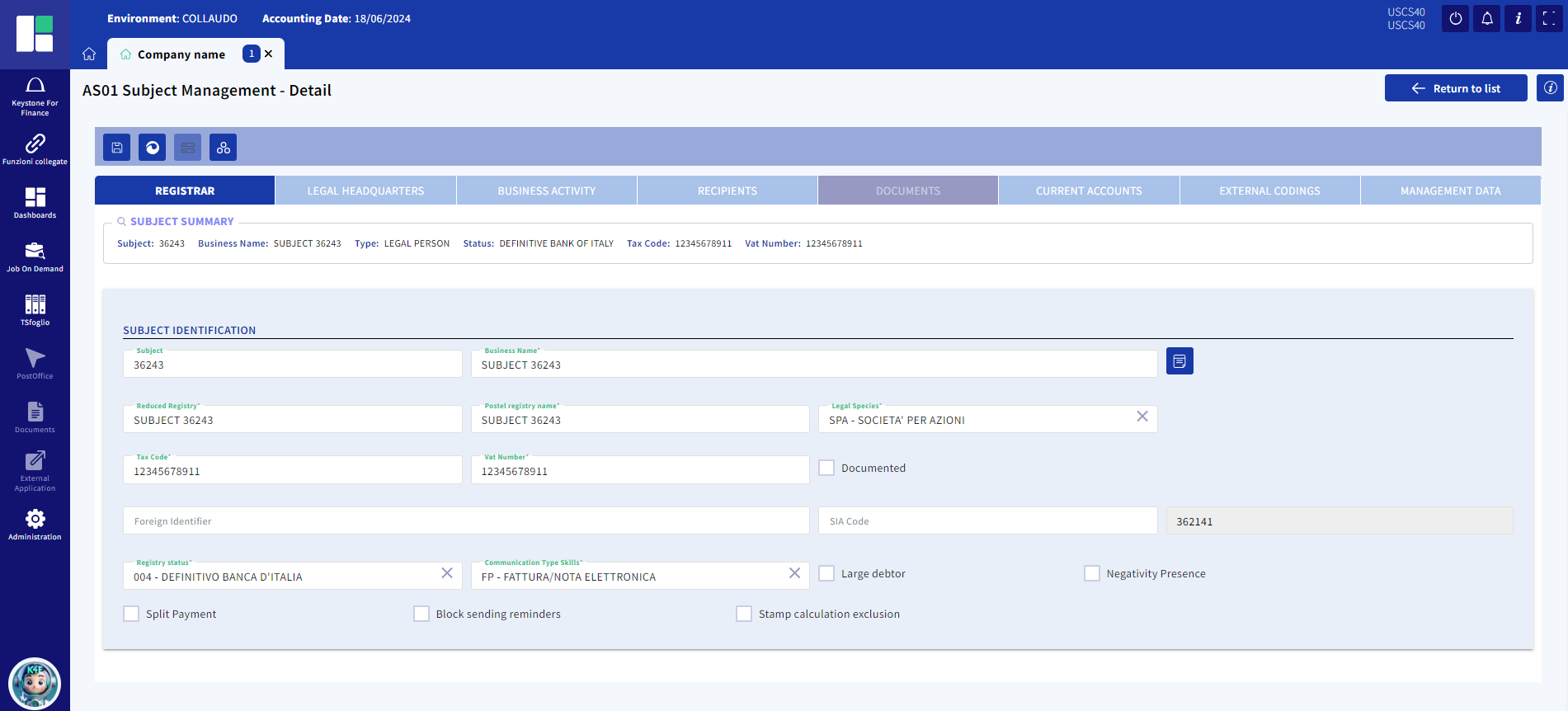

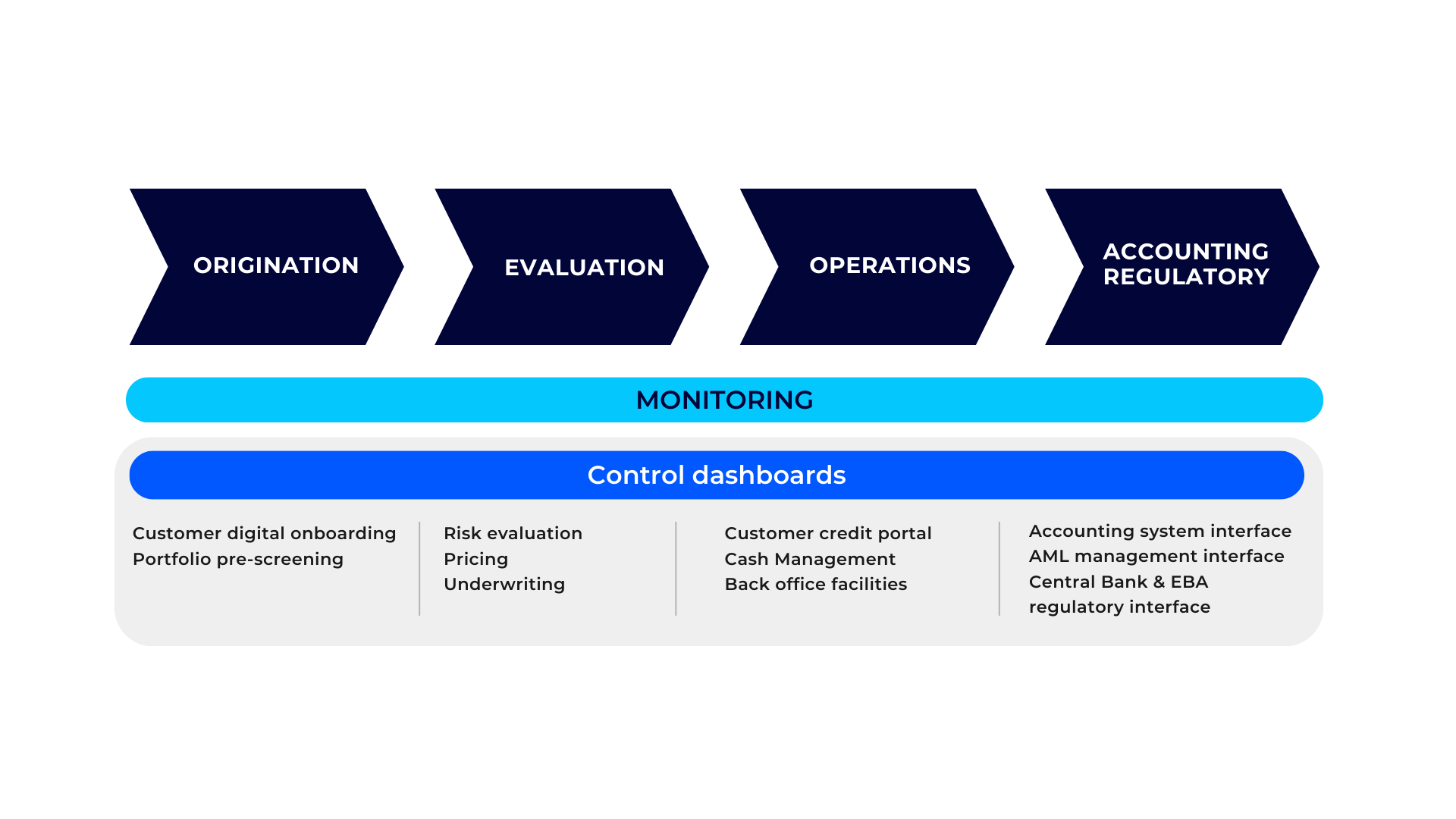

Keystone for Finance Platform

“Keystone for Finance” – K4F – is an end-to-end application platform for the management of financial products destined for financing of current assets. It is based on a multi-tier architecture which features a high level of portability and scalability:

- It can be installed in-cloud, on departmental machines, or on mainframes

- It works on different DBMS (DB2, Oracle)

Finwave’s offering includes various possibilities in relation to the different organization and different size and requirements of its clients:

- Insourcing: the application is supplied under a user license and is installed on operating environments managed directly by the client. In this case, in addition to the installation and any migration and startup activities, Finwave also offers an application management service

- Full outsourcing: the application is installed at a Finwave partner data center, which also provides the facility management services in this case

- Business process outsourcing: in addition to the full outsourcing service, Finwave provides both operations and finance services

K4F 3.0

K4F 3.0 represents Finwave’s latest generation of Factoring management systems, following a complete rewrite of the online and batch application components, through a simplification of the system’s base architecture and a complete overhaul of the user experience for the back-office and front-office users.

This system version can also be installed on departmental environments and/or cloud architectures.

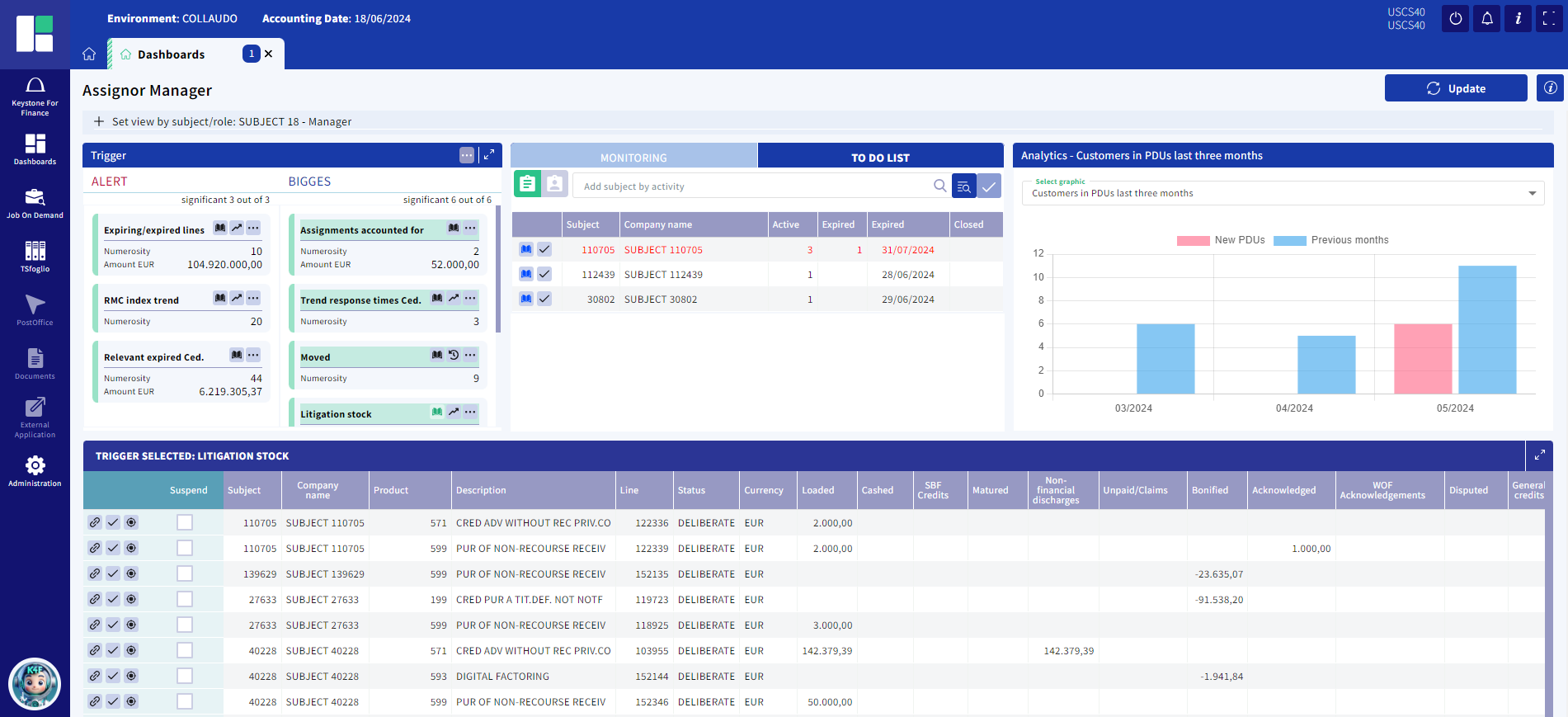

The new monitoring module is structured as a series of dashboards which aim to provide the user with a range of automatic information in relation to the company role they cover.

There are two types: “portfolio” dashboards, which present data on the basis of the client portfolio to which the user is connected, and “area” dashboards, which present global data in relation to the activity that the department handles.

The data can be consulted through drill-down navigation and via a control dashboard from which the user can launch a series of actions: activate monitoring on available triggers and manage a to-do list for actions to be performed on the established dates.

The information managed within the dashboard will be:

- Classified by type, distinguishing between the triggers (approx. 120) linked to trend analysis with respect to the risk indicators

- Aggregated at a summary level but with the possibility of drill down to assignor/obligor counterparty or relationship or pair depending on the type of trigger

- Integrated with graphical tools for improved navigation

- Parametrizable at two levels:

- on the business/organizational model of the bank,

- or by the user themselves on the basis of their specific requirements

The dashboard is also a tool able to operate in relation to the organizational/hierarchical structure of the bank.

WOF - Web Online Factoring

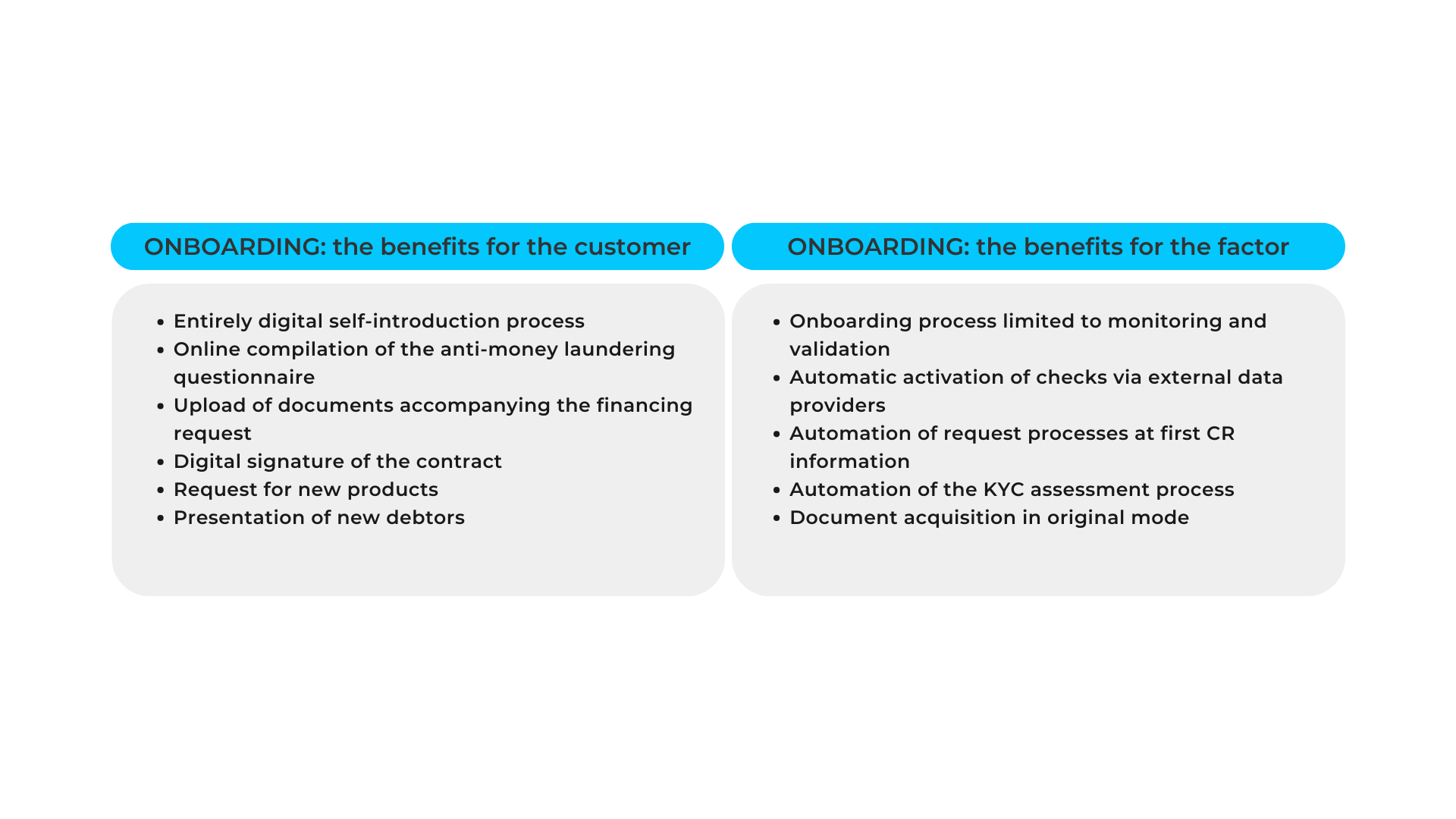

This is the component of the platform designed to manage the client Onboarding phase and the subsequent management phase (Self Factoring).

The onboarding module is dedicated to the gathering of data and documents required for the preparatory phase, in addition to the management of the contractual phase.

Both modules incorporate digital signing and timestamping services. Integration is possible with services provided directly by the factor, or to use the platform’s native configuration, created in partnership with INFOCERT.

The modules

Onboarding module

The Onboarding module is dedicated to the gathering of data and documents required for the preparatory phase, in addition to the management of the contractual phase.

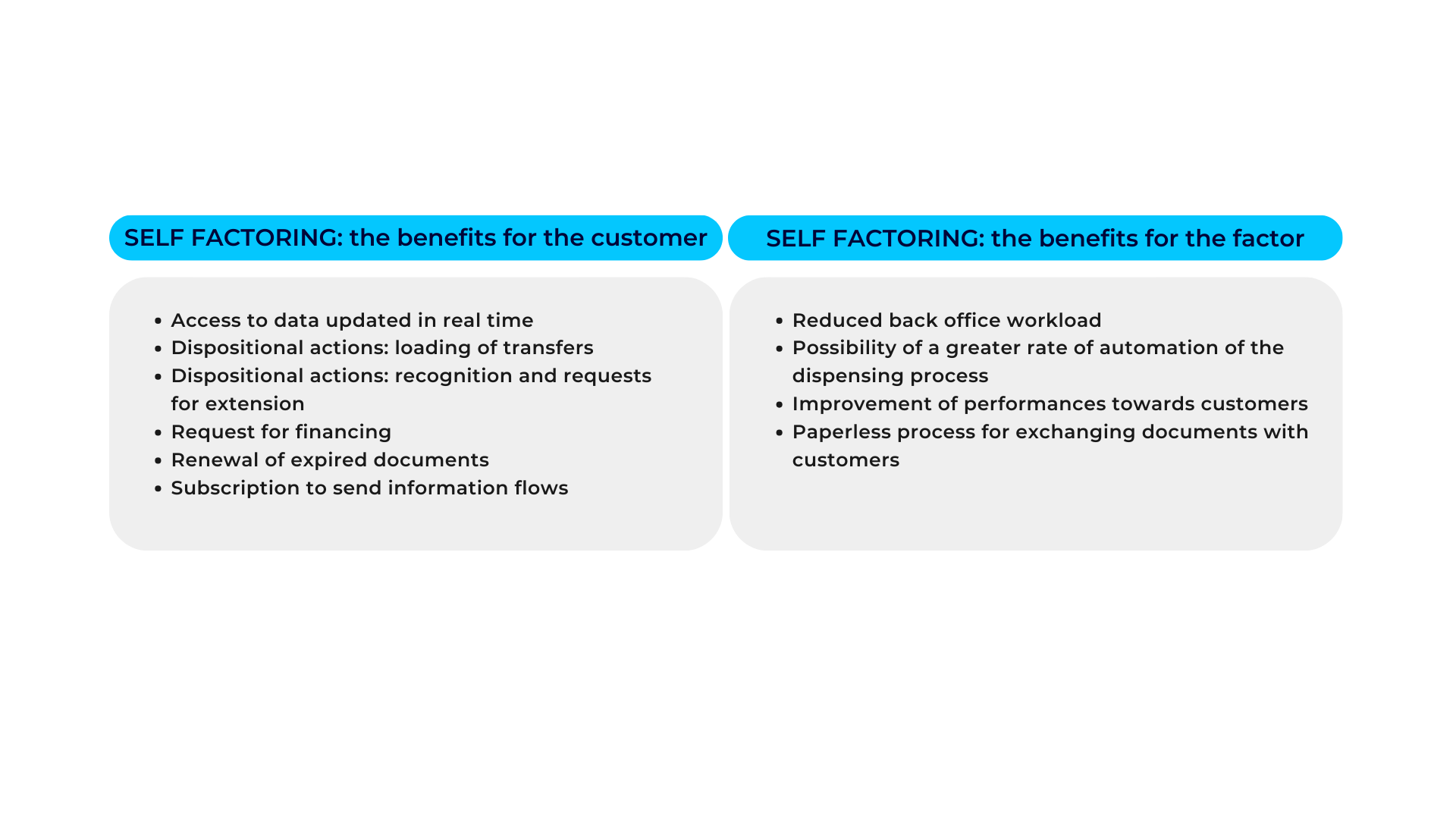

Self Factoring module

The Self Factoring is a client portal with 24/7 availability and allows management of the assignor and the obligor operations towards the Factor.

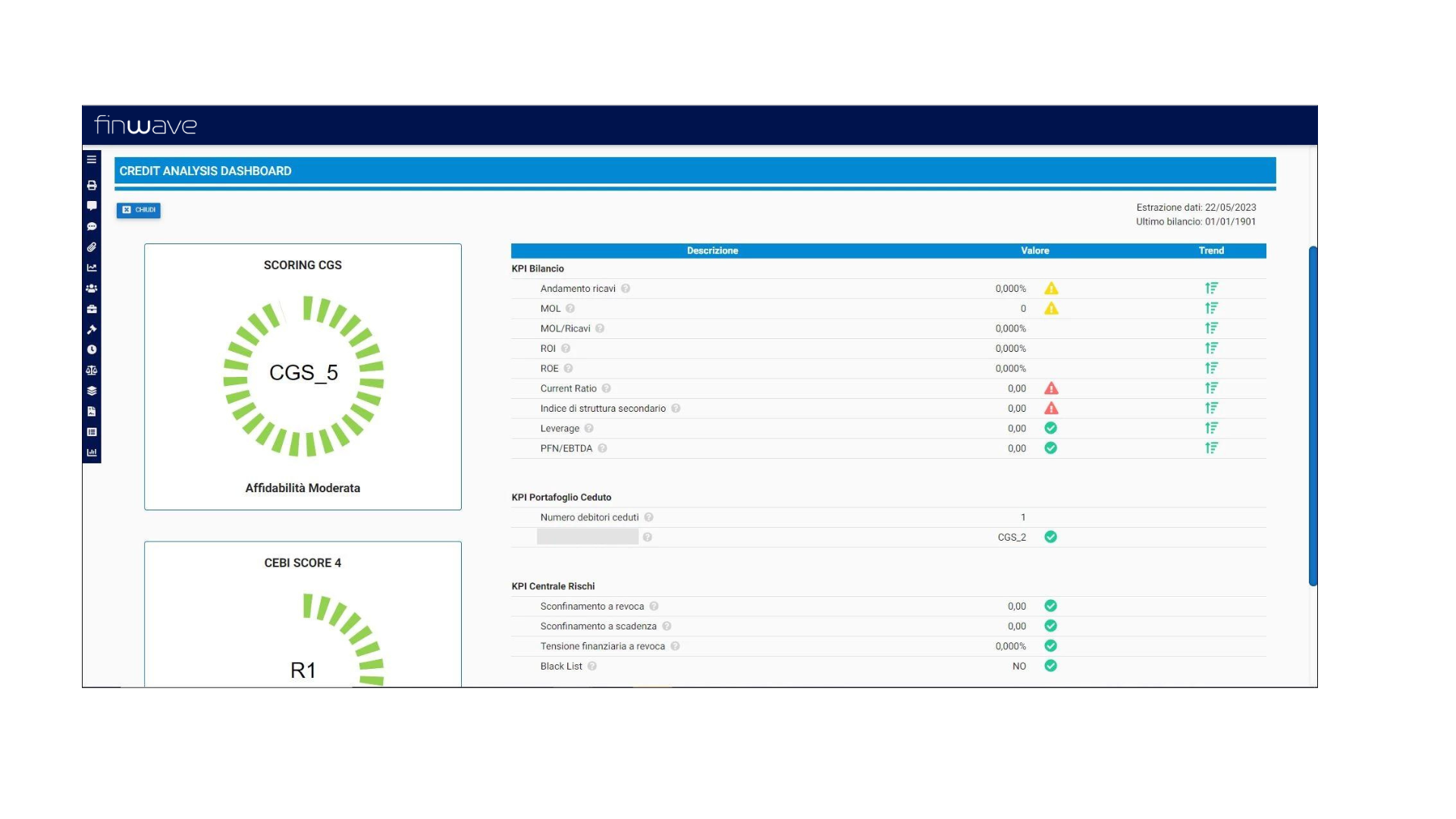

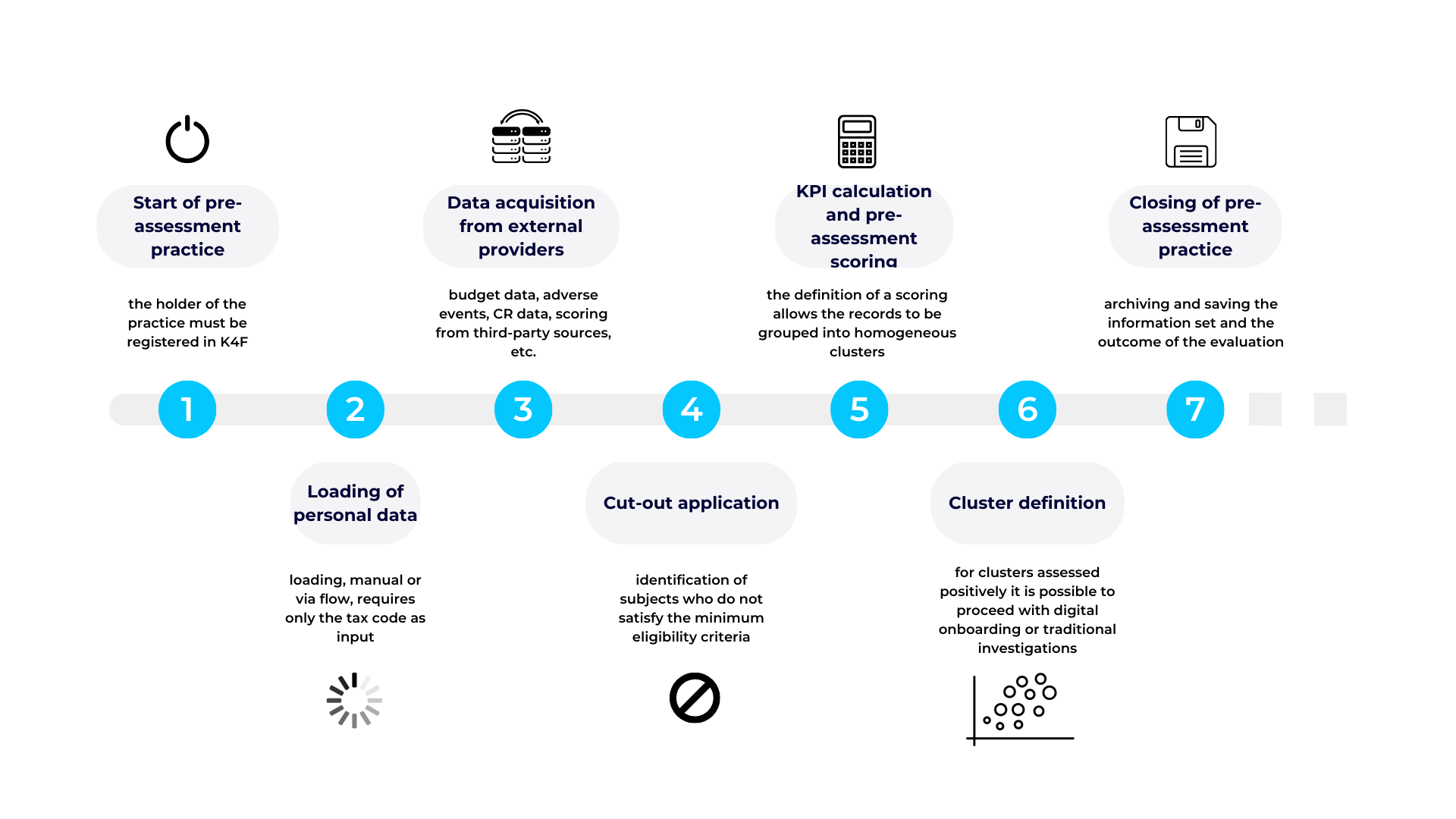

Credit Worthiness (PEF)

This module allows all aspects and peculiarities of the credit approval and review processes to be managed using homogeneous risk evaluation and management criteria.

The individual applications are always at subject level, that is the party to whom the application relates are evaluated for risk at an overall level. The application therefore includes and incorporates all risk positions assigned to the subject, whether they are new requests, renewals or revisions, or existing credit facilities.

It is also possible to use multiple approval workflows and manage the decision-making matrices provided for by the bank’s credit regulations.

The module allows the integration of an external decision-making matrix, provided by the factor, or the management of a customized matrix, whose limits can be managed parametrically, both in terms of the tuning of the algorithm for calculating the total risk, and the roles assigned to the various users. It is possible to define multiple decision-making workflows.

The module allows integration of external tools and Infoproviders for the management of specific risk aspects.

This module allows the analysis of a list of subjects (assignors presented by a reverse debtor, or obligors presented by an assignor, or else prospects obtained from a trade association or an Information Provider), through a scoring process based on ratings obtained from external providers or calculated internally on the basis of a customizable algorithm.

The calculated score can be further combined with the results provided by external risk evaluation tools. In this area, Finwave has developed partnerships with specialized player such as:

- MODEFINANCE

- ARISK

At the conclusion of the screening process, the system allows for the automatic extraction of “valid” subjects from the portfolio on which an evaluation can be performed.

K4F 3.0 manages a wide range of financial products linked to Factoring:

- Factoring with and without recourse, domestic and international, with and without notification of the obligor

- Advances on future receivables (contracts, work progress)

- Purchasing of commercial receivables (IAS and non-IAS operations, spot and revolving)

- Purchase of tax credits

- Factoring in captive environments (e.g.: automotive)

It also represents an important tool for the management of supply chain financing:

- Reverse Factoring

- Confirming

Stand alone, or through integration with different marketplaces. In particular, Finwave has partnership agreements with:

- POLARIS

K4F & IBM Z

The high performance, reliability and continuous availability of IBM Z are the perfect ingredients for developing and providing all the specific functions of the highly specialized sector of K4F – Keystone for Finance, the vertical end-to-end solution for all financial operators operating in Factoring and Supply Chain Finance.

Read the case history

Do you need advice?

Our clients are the protagonists: our solutions are totally customizable to your actual needs and requirements.

Contact us

Innovation

We bring the future forward with our innovative digital solutions, to help you simplify the most complex operations.

Find out more

Careers

At Finwave, we don’t hire people based solely on their CVs. Education and experience are important, but so is the desire to gain new experiences and improve: we are looking for people open to challenges and ready to grow as part of a team. Explore our career opportunities and join the Finwave Group’s talent community!

Discover the Finwave experience

Case History

Over the years, we have worked with hundreds of companies.

Each project has had its own story – its successes, its goals, its main players.

Here are just some of them.

K4F for Automotive Market

The client is expanding its business, focusing on the expansion of its factoring offering, while still maintaining its distinctive offering in the management of “automobile” products.

Learn more

Digital Factoring platform

Finwave has made available the new PEF 3.0 Platform connected to the K4F Factoring management system for the complete management of all technical market forms.

Learn more

FINWAVE collaborates with IBM Z to accelerate modernization journey

Learn more

K4F and IBM Z: innovation, always

Learn more

Need more information?

One contact is enough to innovate your business.

We invite you to read the marketing information.